You might do both at the same time or you might focus on one at a time.

Let's break it down:

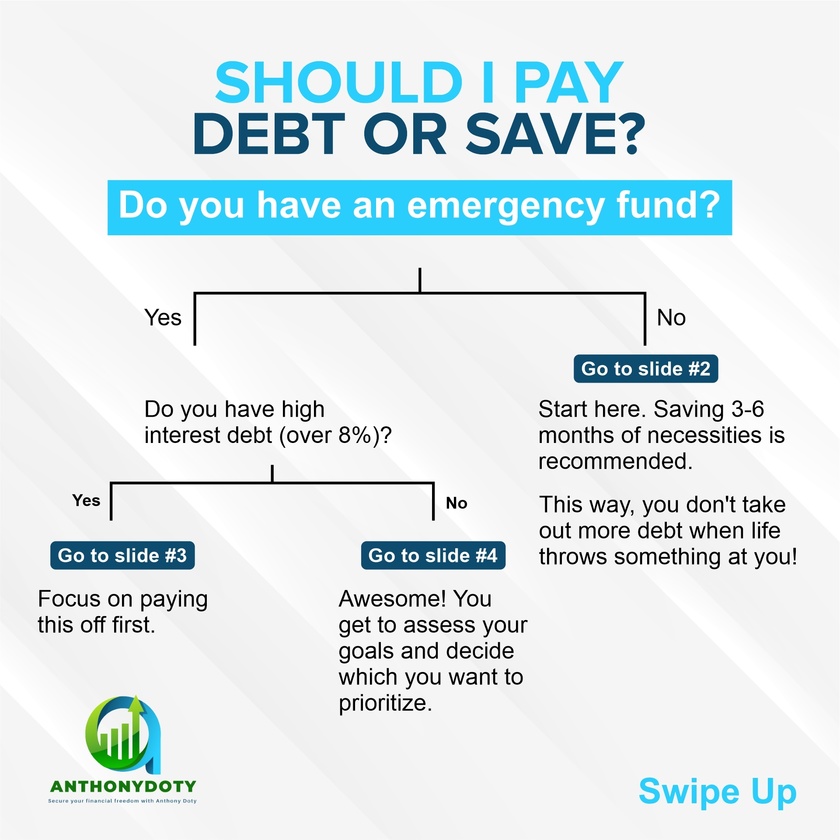

1️⃣ Start with building an emergency fund. 3-6 months is a great buffer to have so you don't take out more debt when something comes up.

2️⃣ Once you've got an emergency fund you feel good about, it's time to reassess how to prioritize debt and savings. If you have high-interest debt (like over 8%), focus on getting rid of this. It's costing you more just to have it around, so let's free up your money!

3️⃣ High-interest debt paid? Great! You now get to decide how to balance debt and savings. Here are some options:

This isn't a cookie-cutter formula. Your strategy may look different. It depends on:

⭐️ Your goals (Do you need to save for something big immediately, or can you put more into debt while saving steadily over time)

⭐️ Your comfort level with debt (does it keep you up at night or are you okay with it)

⭐️ Your comfort level with savings (do you feel more secure with a bigger cushion or are you solid with your cash flow)

🌐 www.anthonydoty.com

.

.

.

.

#personalfinance #cashmanagement #investmentstrategy

#emergencyfund

#debtprioritization

#highinterestdebt

#financialstrategy

#personalfinance

#debtfree

#savingsgoals

#financialsecurity

#moneymanagement

#debtfreejourney

#smartmoneychoices

#financialfreedom

#savingsstrategy

#debtreduction

#financialgoals

#budgeting

#financialplanning

#moneytips

#debtmanagement

#savingsplan

How to Gain Real Wealth & Peace of Mind 🌟 #shorts

#wealth #peaceofmind #financialfreedom #moneytips #financialsecurity #stressfree #budgeting #wealthmindset #financialpeace #moneymanagement #trackspending #financegoals

Budget friendly self care swaps! This is so needed for me today 🧘🏻♀️☕️🧖🏼♀️

🌐 www.anthonydoty.com

.

.

.

.

#financialindependence #financialfreedom #financialliteracy

#SelfCareSunday

#BudgetFriendly

#WellnessWednesday

#Mindfulness

#SelfCareRoutine

#SelfLove

#AffordableWellness

#HealthyHabits

#MindfulLiving

#HolisticHealth

#SelfCareTips

#WellnessJourney

#MindBodySpirit

#WellnessHack

#BudgetWellness

#AffordableSelfCare

#HealthyLifestyle

#WellnessSwap

#HolisticLiving

#SelfCareChallenge

#MindfulChoices

#WellnessGoals

#SelfCareHacks

#BudgetBeauty

#PositiveVibesOnly

If you HAD to pick one... which would it be?!

🌐 www.anthonydoty.com

.

.

.

.

#financialindependence #financialfreedom #financialliteracy #personalfinance #investing #financialeducation #finance #money #debtfreecommunity #financialplanning #budgeting #debtfreejourney #debtfree #wealth #financialgoals #investment #financetips #financialadvisor #business #entrepreneur #wealthbuilding #moneymanagement #passiveincome #stockmarket #budget #moneymindset #moneytips

Hey, everyone! I want to share a personal story with you that taught me some important lessons about credit and financial management. 😬

Recently, I lost $23,000 in available credit overnight with the X1 Card. Waking up to find out that a massive portion of my credit limit had disappeared was a shock, to say the least! This sudden reduction really got me thinking about how credit limits can impact our financial health—especially when we least expect it.

💳 What Happened:

The X1 Card issuer decided to lower my limit without warning, likely due to changes in my credit score or spending patterns. While it didn’t leave me with a major financial issue, it did have an immediate impact on my credit utilization, which can affect my credit score if not managed properly.

⚠️ Why It Matters:

Credit limit reductions like this can catch you off guard, especially if you rely heavily on one card. It’s a reminder to always monitor your credit and be prepared for changes.

💡 What You Can Do to ...

Hey WealthWithDoty family, I wanted to share my incredible journey with you all. Before meeting Holly, I was struggling with multiple businesses and no clear direction. But thanks to her amazing coaching and the AIM methodology, I've transformed my approach and regained my focus.

Check out video here:

If you're feeling stuck or need guidance, I highly recommend connecting with Holly. She can make a real difference in your journey, just like she did in mine! 🙌

🔗 Connect with Holly > https://Links.Anthonydoty.com/s/Holly

#FinancialFreedom #Empowerment #SuccessStory #BusinessCoach #FinancialCoach #EntrepreneurLife #OvercomingObstacles #FocusAndAchieve #TransformYourLife #FinancialSuccess #MindsetShift #Motivation #PersonalGrowth #BusinessJourney

Which of these financial tips do you apply?

🌐 www.anthonydoty.com

.

.

.

.

#financialindependence #financialfreedom #financialliteracy #FinancialFreedom

#Investing

#Budgeting

#PersonalFinance

#MoneyMatters

#WealthBuilding

#RetirementPlanning

#SmartSaving

#DebtFreeJourney

#FinancialGoals

#FrugalLiving

#CreditScore

#SavingsChallenge

#PassiveIncome

#FinancialLiteracy

#SideHustle

#CashFlow

#InvestmentTips

#BudgetTips

#MoneyManagement

#EmergencyFund

#FinancialWellness

#SmartSpending

#RetireEarly

#RealEstateInvesting